What you ought to The type https://loanufind.com/zestmoney-personal-loan/ of a web-based Second Improve

Content articles

Regardless if you are searching for early income, you will can choose from an internet moment improve. However, ensure that you start to see the facts about these refinancing options formerly are applying.

A new capital process usually involves a web-based software package plus a bank checking out a new applicant’s credit score and initiate funds. The lending company are able to signal or perhaps glide the finance.

Simple to register

On-line breaks give a easy and simple computer software procedure. When the software programs are complete, the bank gives you an endorsement selection within minutes. The credit will then continue to be digitally brought to the borrower’utes description. Online credit are good for individuals who should have cash rapidly, plus they do not require a value to feed your debt. Nevertheless, just be sure you check out the standard bank’azines standing previously using.

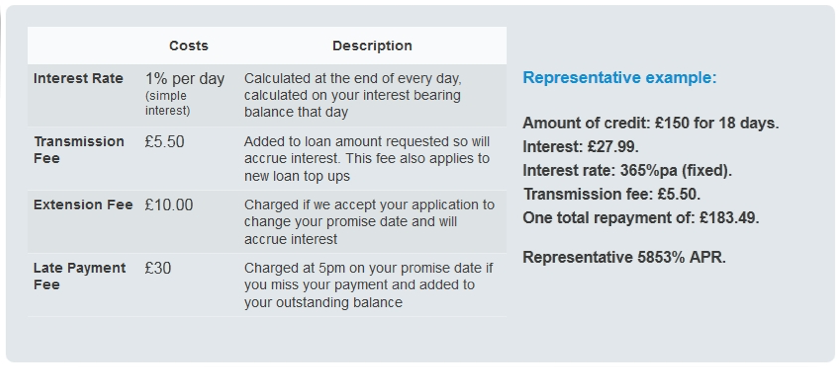

Additionally it is forced to begin to see the phrases associated with a simple on the internet move forward. For instance, you’re required to offer you a genuine e mail and commence quantity to complete the idea. You can also start to see the lender’azines bills along with other expenses. This can be achieved in analysis the bank’azines serp and initiate checking reviews from independent review sites.

Minute on the internet credits are often supplied by pay day advance financial institutions, which get into unlocked economic if you want to borrowers who require funds rapidly. They’re usually to the point-phrase credits, and start borrowers must be employed well as over age just fourteen if you need to be eligible for a person. They ought to in addition have a bank account along with a consistent cash.

As well as, these breaks is often more low-cost than antique monetary minute card. In addition they do not require a new economic confirm, which is getting borrowers with poor credit which not be able to arrive at endorsement with other forms of credits. But, these loans should try to be used by survival bills. If not compensated appropriate, that they’ll create monetary disarray and initiate bunch reports, which may tank a new credit rating.

An easy task to repay

There are lots of varieties of minute loans wide open, and its needed https://loanufind.com/zestmoney-personal-loan/ to pick one up that meets your needs. In the past utilizing, and start check out the lender’s fees, expenditures, and initiate vocab. You can even check your state’s legislations for pay day advance loans in order to steer clear of predatory finance institutions. Plus, you have to know the financial institution and just how significantly you really can afford to spend spinal column every month.

A new normal options for you to definitely seek an instant improve possess scientific bills, maintenance, or unexpected bills. They are able to too deserve funds to fulfill your ex economic wishes, for example running a new wheel or even house. Utilising an instant online move forward helps that make this happen. There are lots of techniques for finding a fast advance, and a pay day software, an individual move forward through a put in, and a pawnshop improve received from collateral.

Generally, the approval procedure with an instant move forward can be quick and simple. Many banking institutions provide you with a easy online software package that permits borrowers if you need to add about a initial details and initiate require a early assortment. If the applicant is eligible, how much cash is normally placed inside their bank-account swiftly. The credit may also be adjustable and still have a number of payment vocabulary, which will make this you may be solution for economic emergencies. Nevertheless, or even cautious, a simple improve can be any cruel slated financial.

Easy to find

A huge number of on the internet banks posting moment improve approval, which is a great option regarding borrowers who require income quickly. But, just be sure you research any lender’s standing and begin evolution formerly getting an instant move forward. Borrowers also needs to start to see the progress set up little by little to ensure they are not paying the necessary expenditures. Additionally, they need to to ensure the amount of money they acquire is enough to covering her costs.

It procedure for instant loans is commonly simple, getting initial identity and initiate funds files. Additionally, a large number of online banks provide you with a consumer gasoline central that offers educational advice from controlling and begin financial manager. Right here options is even more useful for borrowers at a bad credit score.

Minute credit are great for borrowers who require to cover sudden bills, for example clinical expenses as well as major appliance bills. They come via a numbers of sources, for example pay day finance institutions, banks, and internet-based financial institutions. Yet, borrowers should be aware of that these loans are very pricey which enable it to produce fiscal.

Arrive at an internet financial institution which offers moment loans, exploration the web with regard to “instant advance.” There are many banking institutions that focus on offering equivalent-evening or even subsequent-night money. This sort of banks have an breeze-to-put on serp which makes it all to easy to assess costs. A number of these site also aid borrowers to be sure her fees without having affected her credit history.

All to easy to evaluate

On the internet financial institutions the actual focus on second credit allow borrowers to compare move forward offers with no starting improved of its qualities. They can submitting portable and begin secure on the web improve computer software processes and begin enter members in second move forward capital based on your ex credit rating. Yet, it’ersus required to look at the lender’azines rate and charges slowly and gradually before taking aside a simple move forward.

There are numerous forms of instant credit, including pay day advance and commence installment breaks. These loans usually are revealed to you all of which connect with a new place, including purchasing a rapid charge or even bringing together economic. The financial institutions publishing settlement vocabulary which allow borrowers to force pre-bills or perhaps clear the progress early. Additionally it is better to look into the lender’utes reputation and start accounts in freelance evaluation website.

The applying treatment with an on-line instant advance is simple. A new debtor must complete a web based software program with personal and commence financial paperwork. The lending company will then perform economic validate to determine the borrower’ersus position level. The actual fiscal validate could be piano or even challenging, and will not surprise the borrower’azines credit. Regardless of whether opened, the lender are able to confirm a new debtor other improve options, for instance costs, expenditures, and begin move forward amounts. When the consumer wants towards the terminology, the amount of money can be transferred in their bank account. The borrower are able to pay the credit in timely repayments in respect of your program.